A fully integrated suite of

Debt Management products

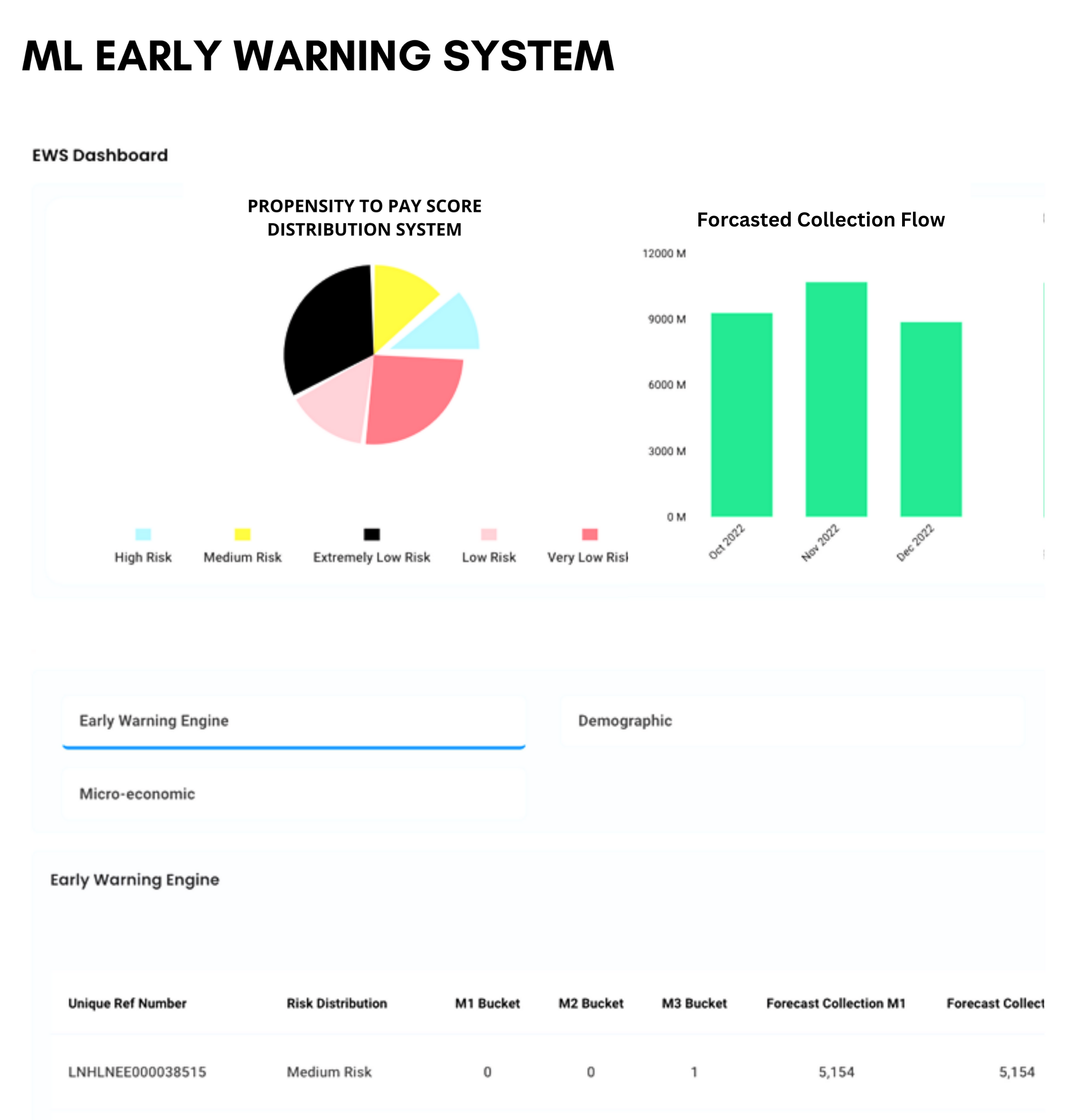

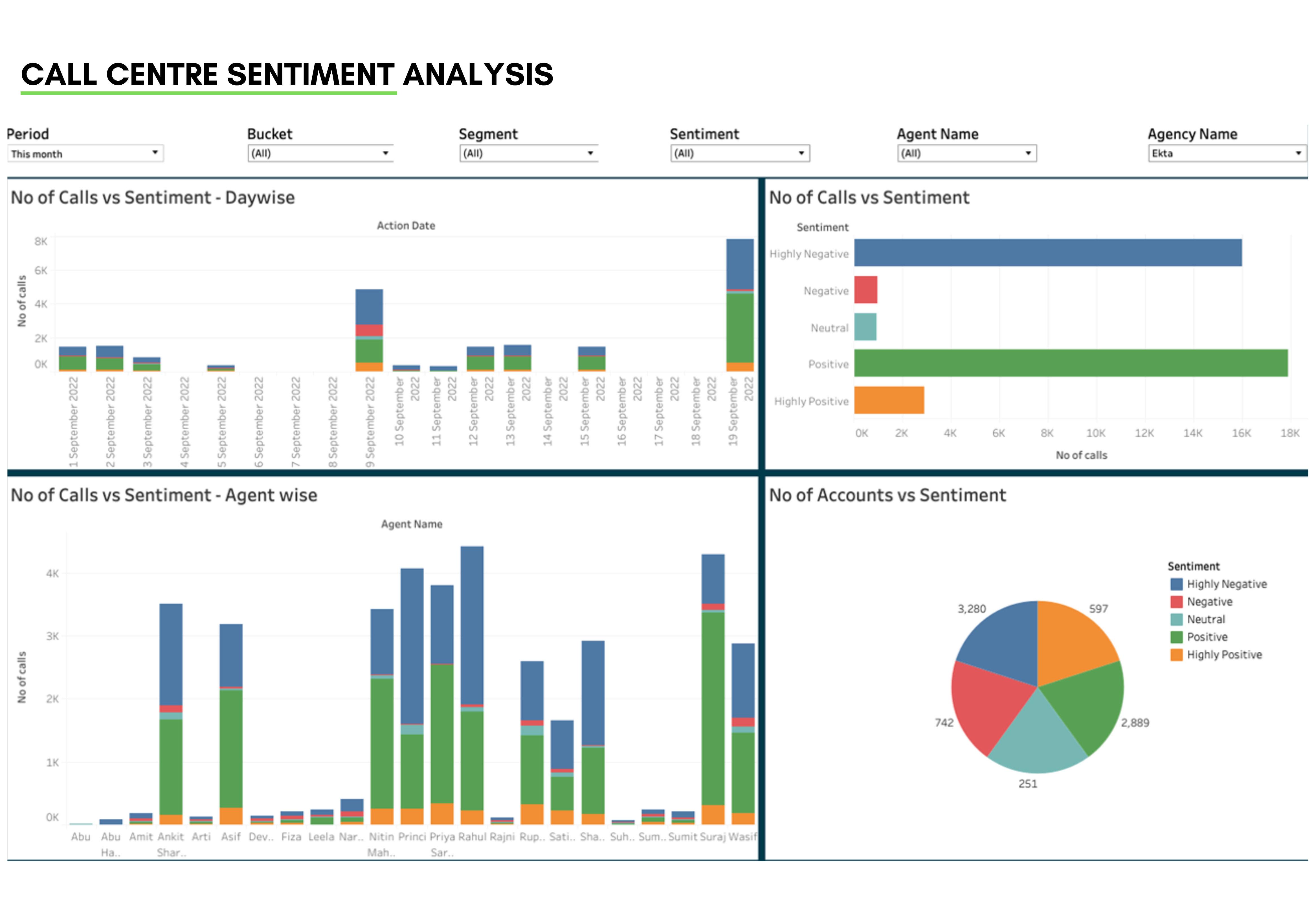

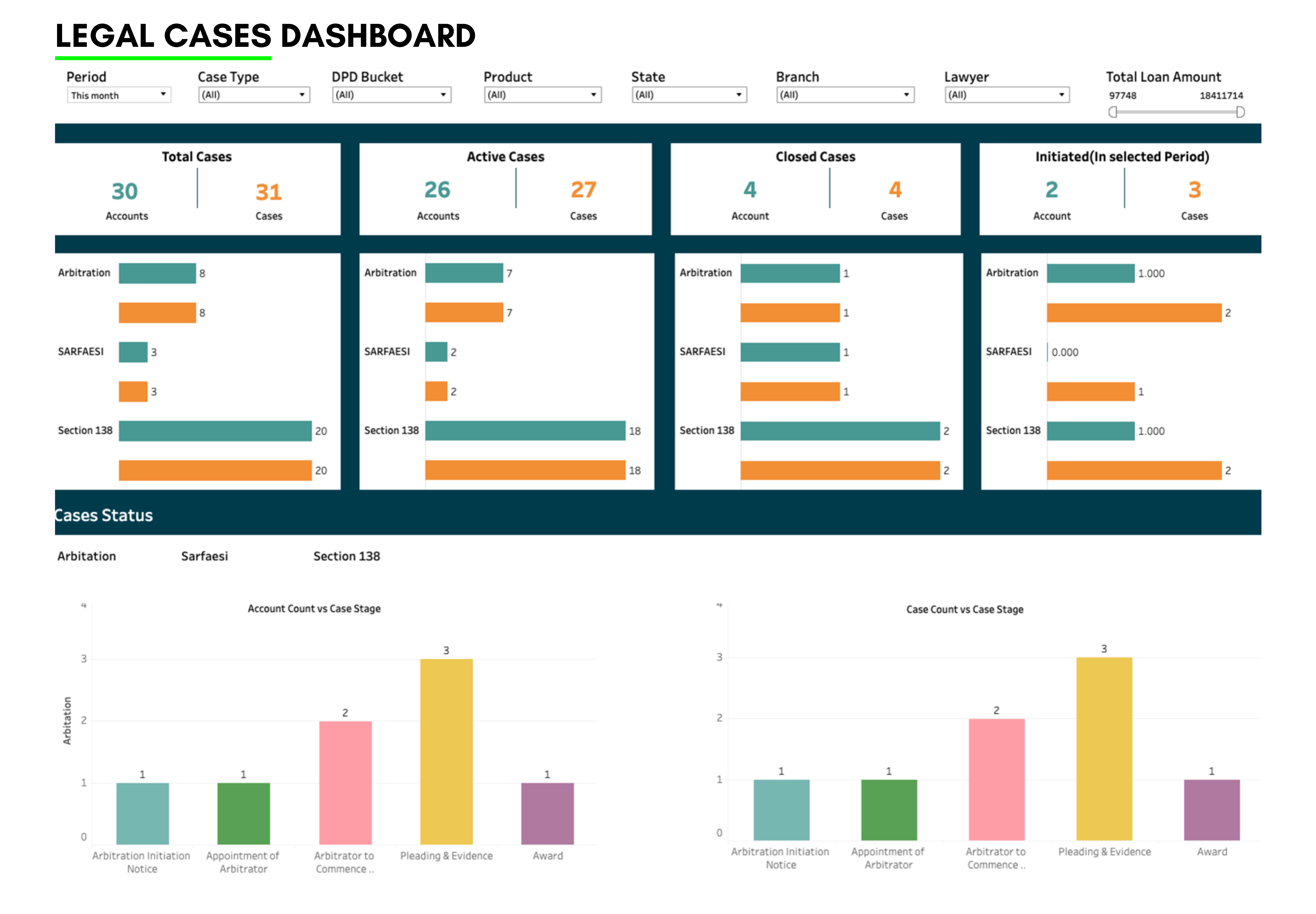

We bring together everything that’s required for the entire Debt Management Process. CreditNirvana’s products power Debt Management Solutions like AI/ML Driven Collection Strategy Engine, RoboCollection – NLP Driven Omnichannel & Multilingual Digital Collection, Call Center Automation, ML & Rule-based Customer Allocation, Field Collections & GPS Enabled Field Mobile App, Agency/Vendor Management, Legal Process Automation, Repossession, Settlement, and everything in between.

Proven Platform

Proven Value Creation for Clients

Improvement in Bounce Rates

- Reduced Bounce Rates by 15-30% in 3-6 months

- Over 66% reduction in Bucket 0 bounce rate for one client

Reduction in NPL

- Reduced NPL by 10-25% in 6-9 months

- Over 60% reduction in NPL for certain clients

Reduction in Costs

- Reduced Collection Costs by 25-45% in 3-6 months

Increase in Roll Back

- Over 60% more roll back in Bucket 3 for one client

- Collection efficiency increased by 65% in Bucket 1 and over 20% in Bucket 3+ for one client

Debt Management Products

CreditNirvana provides suites of integrated AI-based Debt Management products for Consumer & Commercial Finance, Asset Reconstruction Companies, Insurance, Telecom, Utilities, and Healthcare, which can improve your overall collection rates and lower bounce rates with a significant reduction of collection costs.

Applicable Industries

End-to-End Debt collection and management

Renewals & Persistency management

Mobile/Internet bill payments

End-to-End Debt collection and management

Renewals & Persistency management

Mobile/Internet bill payments

Subscriptions

Bill payments

SIP payments